Fixtures is NOT considered a current asset. Fixtures is included in property, plant, and equipment, which is a category of long-term assets for a business.

When a manufacturer's net income exceeds the cash flow from operating activities, the quality of those earnings is questionable. The company's financial stability and the sustainability of its reported earnings may be questioned in light of this circumstance.

The earnings of the company before interest and income tax expense are divided by the amount of interest expense to determine the times interest earned. In this instance, the earnings before interest and income tax expenses come to $600,000. This is calculated as follows: $400,000 + $140,000 + 60,000. By dividing that sum by the $60,000 in interest costs, we get 10.0.

Stock is NOT regarded as a quick asset. The items that can be converted into cash Cash, Temporary Investments, and Accounts Receivable are included in the quick ratio.QUICKLY

In the accounting records, only transactions with a measurable dollar amount are included.

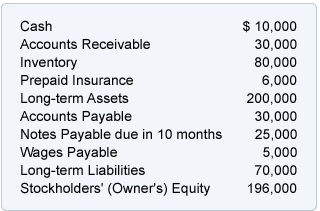

The quick ratio or acid test ratio equals [(Cash + Temporary Investments + Accounts Receivable) / Current Liabilities]: 1 = [($10,000 + $0 + $30,000) / $60,000]: 1 = 0.66667: 1 or 0.7: 1 when rounded.

Current assets minus Current Liabilities equals Working Capital. In this instance, that translates to $66,000 – $60,000 = $126,000.

The cost of goods sold / average inventory is known as the inventory turnover. This amounts to $525,000 DIVIDED BY $105,000 = 5.0 in this instance.

The credit sales divided by the average accounts receivable is the accounts receivable turnover. That means that in this instance, $830,000 / $83,000 = 10.0.

A financial metric called the current ratio assesses a company's liquidity and ability to meet short-term obligations. It is determined by dividing the current assets by the current liabilities of the company.

Divided by the accounts receivable turnover rate of 10.0, 365 days in a year would equal 36.5 or 37 days of sales in accounts receivable.

Divided by the inventory turnover rate of 5.0, 365 days would equal 73 days, or the number of days sales occur in inventory during the year.

The current value is relatively close to the recorded and reported amounts because current assets typically "turn over" within a year. Additionally, the current values of current liabilities would be similar to the reported amounts.

The current ratio is calculated as [current assets / current liabilities]: 1. That amounts to [$126,000 DIVIDED BY $60,000]: 1 = 2.1 : 1.

The difference between a company's current assets and current liabilities is known as working capital. It represents the money a business has available to pay for short-term financial obligations as well as ongoing operational costs.

The company's net income after taxes DIVIDED BY the average stockholders' equity for the year results in the return on equity. In this instance, it means that $400,000 / $2,000,000 = 20%.